Fewer people file auto insurance claims after an accident than you think

Insurance companies create their business models by assuming and diversifying risk. These companies make money by having an individual, company, or organization pay a specific amount of money, a premium, in exchange for a promise to pay out any losses that may occur to the insured. In the case of auto insurance companies, a driver usually pays a monthly or annual premium in exchange for coverage in the case of an accident.

The insurance industry relies heavily on a process known as underwriting. Underwriting refers to the assessment of an individual to determine the risk he or she provides to the insurance company and determining a price at which the insurance company is most likely to benefit financially; this price is known as the premium. Auto insurance premiums are determined by several factors, including a vehicle’s make and model, safety features, usage, and information on the driver such as tickets and accidents. Since 2010, the cost of auto insurance has risen 52.2 percent compared to the increased cost of living at 17.2 percent, according to the Insurance Information Institute (III).

Premiums play a large role in how insurance companies maintain profitability. Many insurance companies use the funds received in the form of policy payments, or premiums, and reinvest that money in the financial market. Additionally, if a policyholder chooses to end their insurance contract or has a lapse in coverage, the company no longer has liability for that driver, but still keeps all the funds received as premiums.

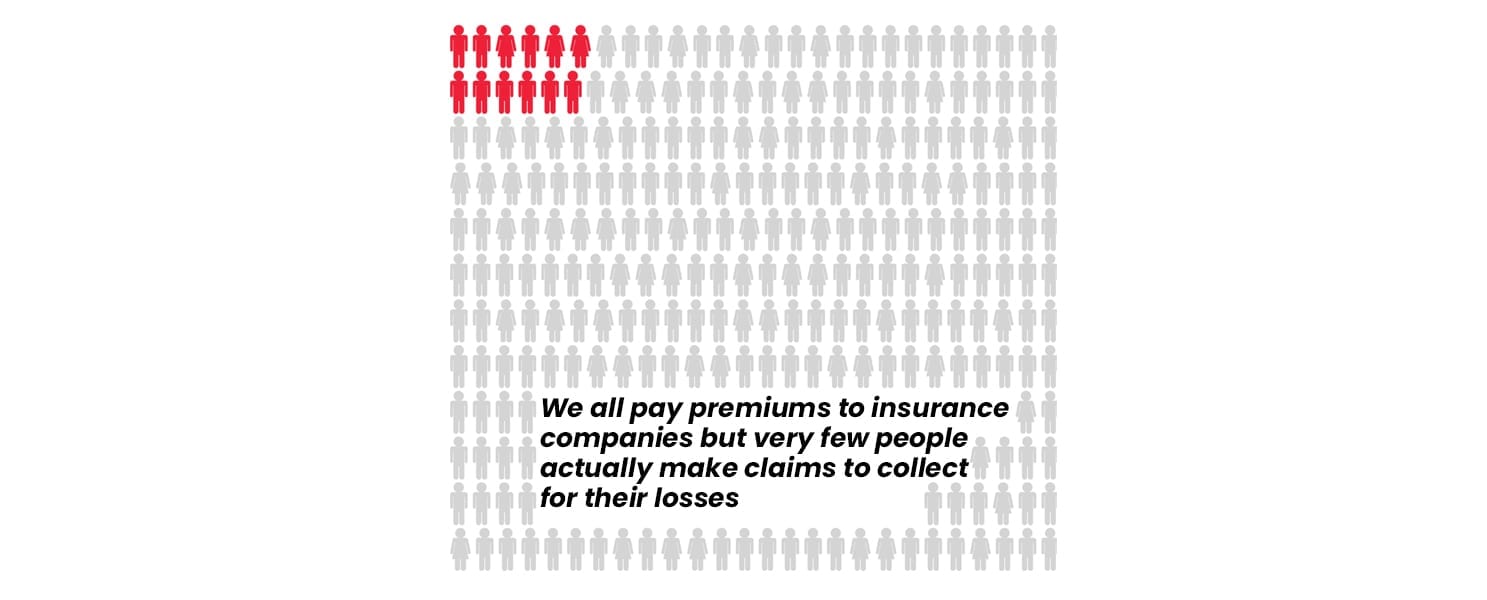

Auto claims fall into three main categories: liability insurance, which covers both bodily injury and property damage; collision insurance; and comprehensive insurance. The frequency for claims filed within those three categories vary drastically. In 2018, the latest year the III has data for, the claim frequency for liability insurance was 1.11% for bodily injury and 3.89% for property damage. For collision and comprehensive insurance, the claim frequencies in 2018 were reported as 6.11% and 3.02%, respectively, according to the III.

Many drivers choose not to submit an auto insurance claim following a minor accident and, instead, pay for the damage out-of-pocket. This decision is usually made out of fear that reporting a claim will result in an increased premium rate for his or her auto insurance. However, filing a claim soon after an accident can be beneficial in the long run. Liability insurance may cover the cost of the damage caused as a result of the accident, as well as any legal defense costs incurred should the at-fault driver be taken to court. Additionally, if the other driver files an insurance claim later, your insurance company may be able to deny coverage.

With the cost of auto insurance premiums at an all-time high for drivers of all levels – ranging from $650 to $1,400 – filing a claim for damage resulting from an accident may give you the biggest bang for your buck. Once a claim is filed, a team of attorneys begins reviewing the claim. Auto insurance companies have deep pockets and the time and resources to stonewall your claim if you try to go it alone. If you are injured in a car accident, hiring a personal injury attorney will ensure you have the greatest chance of being compensated for the damage and injuries sustained as a result of the crash. At Bond Legal, you can rest easy knowing you have a team of experienced attorneys who put the needs of and justice for car accident victims first.